Menu

How to design a two-sided marketplace transaction flow: A Step-by-Step Guide (2025)

Etsy has transformed the way people buy and sell handmade, vintage, and unique goods. This guide explores Etsy’s business model, how it became a global marketplace, and what it takes to build a similar platform. Learn the key steps to creating a thriving online marketplace, from selecting a niche to designing a scalable and seller-friendly infrastructure.

In the last year, my team & I have developed hundreds of two-sided marketplaces.

With all of this experience, we’ve created an article that walks through the critical decisions you need to make in order to design your two-sided marketplace transaction flow.

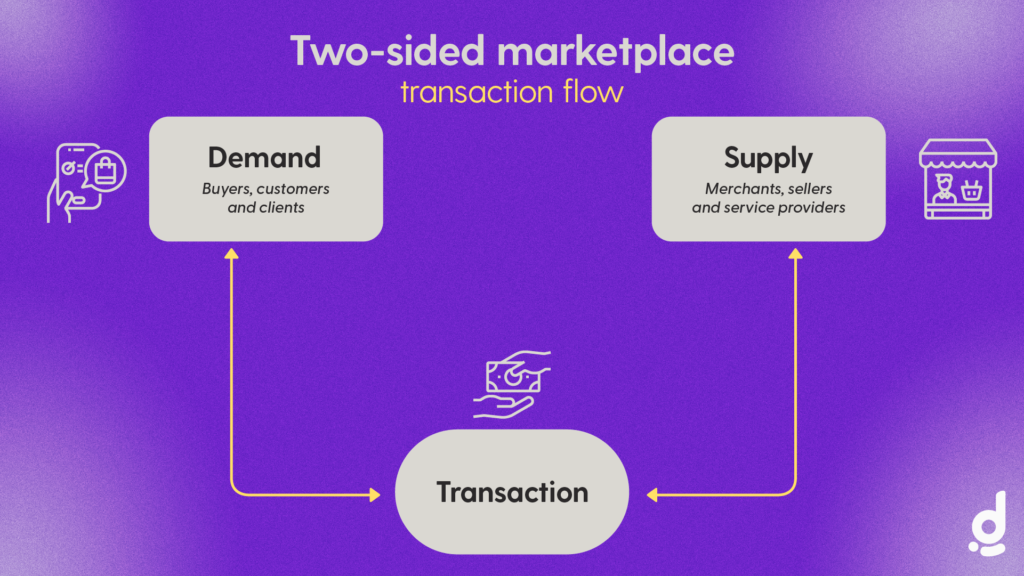

But first of all, what is a transaction flow anyway?

The transaction flow describes the way that your marketplace customers & providers (buyers & sellers) interact with each other. This includes the actual payment from the customer to the provider, but it also includes all other interactions that the customer & provider have with each other e.g. two-sided reviews, messaging between customer & provider & so on.

Many first time marketplace entrepreneurs track how many users sign up to their marketplace. However, this is a vanity metric since the purpose of a two-sided marketplace is to facilitate transactions between users. Therefore, without transactions your marketplace is not providing value to anyone, regardless of the total number of users.

Value of your marketplace is therefore judged by the number of transactions that take place. This means that the correct metric to track is the liquidity of your marketplace. The liquidity of a marketplace refers to the efficiency with which a marketplace matches buyers and sellers or, put another way, it is the ease with which the marketplace enables buyers & sellers to complete the marketplace transaction flow. That is why taking the time to think through your transaction process & to make it as smooth as possible is really important to minimise friction & facilitate transactions between users. Your transaction flow IS your marketplace’s value proposition.

Measuring liquidity is complex & will differ between marketplaces. Learn more about marketplace metrics in our marketplace metrics bog.

The transaction flow at a high level

A two sided marketplace transaction flow encompasses three main elements:

Notice that the transaction flow describes the entire interaction between customer & provider. This includes the two-sided review step.

This flow seems simple enough, but in reality marketplace transactions are about as complicated as online payment processes get. Let’s look at each of these steps in more detail & learn what the critical steps are in the development of the transaction flow.

Step 1. A customer makes a payment

When designing your apps two-sided marketplace, the first thing that you need to decide is, are you going to take payments on your marketplace or not?

Since most marketplaces make their money by deducting a commission on transactions, this means that the answer to this question is normally “yes”. This is not always the case however, for example the marketplaces Craiglist & Thumbtack made the strategic decision to not handle online payments.

If you do decide to operate a commissions model, you will need to choose a payment service provider. Many payment service providers offer payment processing solutions that are specifically designed for two-sided marketplaces. These included solutions such as Stripe Connect, Paypal, MangoPay & Adyen. These payment processing solutions can lower the development time for implementing online payments & have also been designed to lower the friction that your customers & providers experience when making online payments.

So – if you do decide to take payment through your marketplace, you will next need to decide on two key points: how to take payments & the steps of the checkout process.

How to take payments

Credit cards are the most common method to take payments. This is because credit cards are globally used. However, some people don’t like using credit cards or don’t have access to credit cards. In particular, credit cards are much less common in developing economies or for certain demographics e.g. students. So if you’re developing a two-sided marketplace for a market like Uganda for example, you might want to investigate alternative methods of taking payment, such as mobile money which is popular in Africa.

To take payments via credit cards, you can use payment processing providers such as Stripe Connect, Braintree Marketplace, Adyen & MangoPay. Each of these payment processing providers comes with their own pros & cons such as the price, integration time, quality of customer support & so on.

It is worth noting that the handling of credit cards is a heavily regulated area. Moreover, regulations vary from country to country & are constantly changing. Therefore it is probably always better to use an out of the box solution rather than trying to develop your own payment system. The costs incurred by using someone else’s payment solution may be high, but it will certainly be lower than the cost of trying to build & maintain a Payment Card Industry (PCI) compliant solution.

Second to credit cards, Paypal is the most popular payment method for two-sided marketplaces. Paypal allows you to make payments without a credit card & also enables transfer of money across borders. Paypal comes with a comprehensive protection program for both customers & providers who operate on your marketplace. Paypal can also increase the adoption of your marketplace early on. This is because Paypal does not require users to share credit card information with a new platform.

Action —

Before continuing:

- Choose a payment provider e.g. Stripe, MangoPay, Adyen, Braintree marketplace, Paypal or other.

Make a note of your answer & then move on to reading about the steps of the checkout process.

The steps of the checkout process

The checkout process is the series of steps that a customer follows in order to select a product or service, complete the exchange &, if online payments are being used, make the payment itself.

Ecommerce stores were the original two-sided marketplace, think Amazon.com. Ecommerce platforms allow users to fill up a basket of products that they want to buy. Users will then go to the checkout where they will make a payment. So you ask yourself the question, does your marketplace need a shopping cart?

Well – the use of shopping carts is still very valid if you expect your users to select & purchase multiple items in one session. However, if you don’t expect your users to make bulk purchases, then the use of a shopping cart is totally unnecessary. Think about developing a two-sided marketplace for rentals, jobs, flights, booking taxi rides or other services. There is no shopping cart on Uber for a reason.

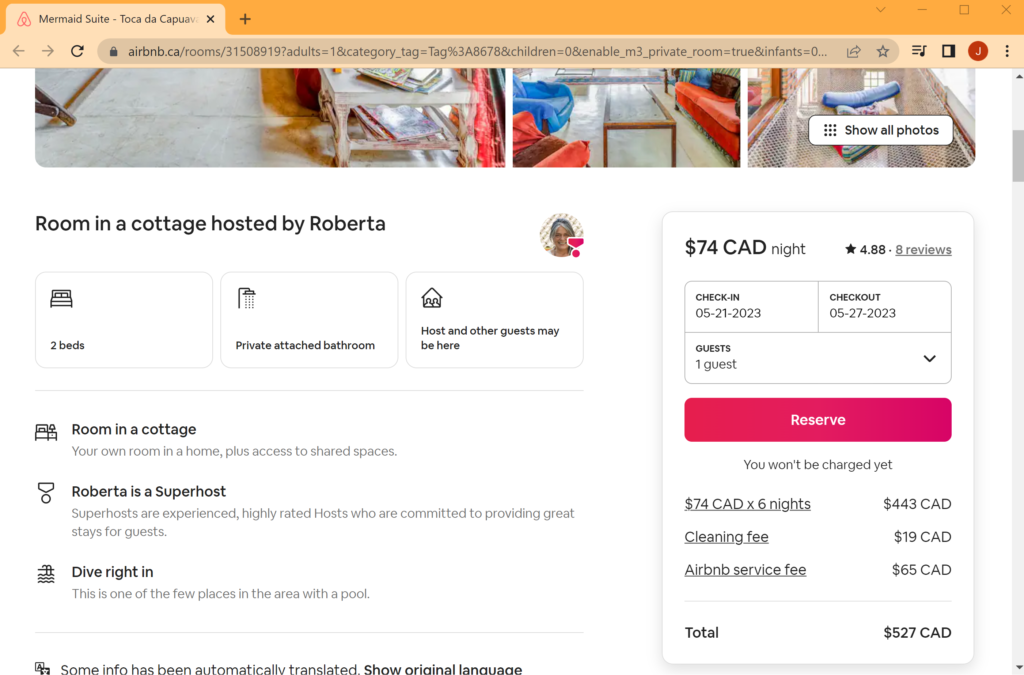

When designing the checkout process for your two-sided marketplace, you want to keep the process as simple as possible. This way you will increase the number of transactions on your marketplace. Airbnb for example fits the entire checkout process onto a single page where you can see the details of the booking, the price & all add-ons. Users of Airbnb can complete the checkout process in one click – it doesn’t get better than this.

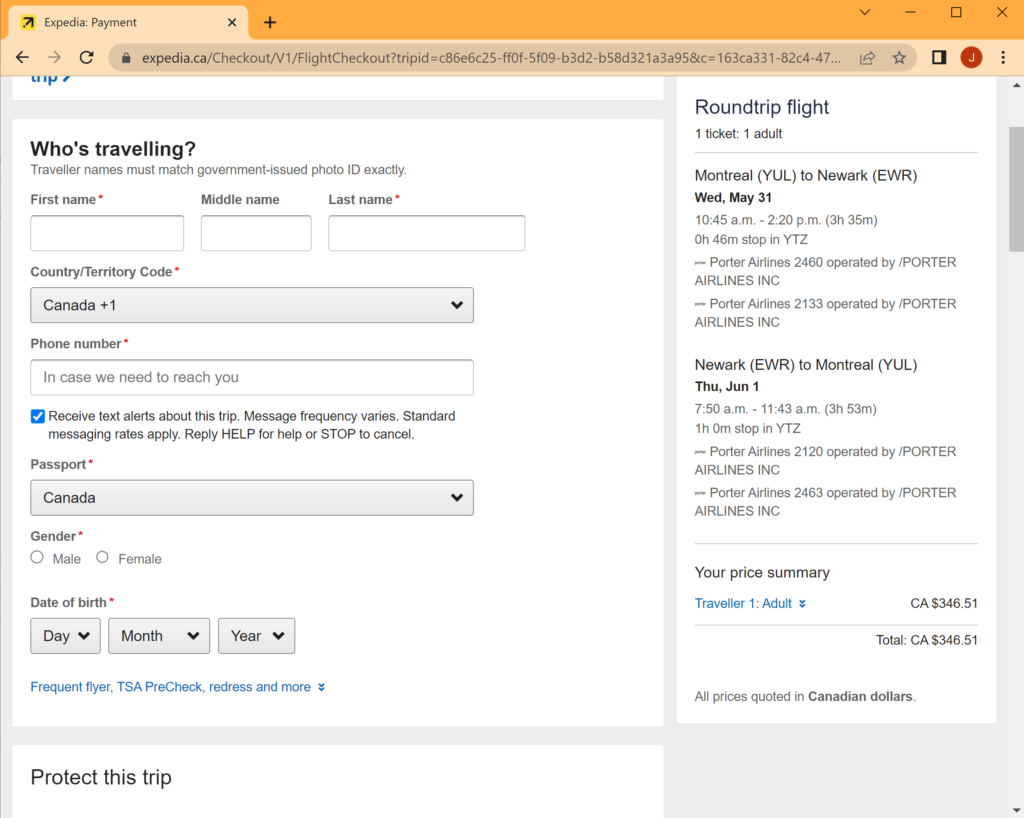

Another thing that you need to consider when building your two-sided marketplace is, are you going to make it a requirement for users to login to complete the checkout process.

Two-sided marketplaces such as Expedia allow users to purchase flights without being logged in. However marketplaces such as Airbnb require users to be logged in. There are pros & cons to both options. For example, if a client can complete the checkout without needing to sign up to your marketplace, this can lower the friction of completing the checkout process. Alternatively, if you demand that users sign up, this will allow you to acquire a user. Airbnb has clearly prioritised user acquisition which means that, after the first booking, the transaction process becomes even simpler & Airbnb has all the customer information to re-engage users in the future. This makes sense for Airbnb since users use the platform regularly however, for services that are used less frequently e.g. hiring a plumber, it may not be as important to acquire the user.

Action —

Before continuing, you need to decide on the following:

- Does your two-sided marketplace need a shopping cart?

- Are you going to make registration mandatory before allowing them to make a purchase?

Make a note of your decisions at this stage & then move on to reading about when money should be transferred.

Step 2. Moving the money to the provider

On traditional ecommerce marketplaces, money is transferred to the provider as soon as the buyer completes the checkout process. This method works great when the availability & the exact price of the product are known ahead of time. However, modern marketplace transactions are significantly more complex & there is no real “one size fits all” approach.

At this stage in your transaction process, you need to make two critical decisions. You must decide: when to move money to the provider & how you are going to move money to the provider.

When to move money to the provider

The easiest way to move money to the provider is to transfer the payment to the provider at the point when the checkout process is complete. This is how ecommerce marketplaces work. However, this solution is not always appropriate. For example, many two-sided marketplaces act as a trusted middleman on transactions that take place on their platform. This is often a core value proposition for the marketplace that protects transactions & guarantees service on their platform.

If you want to set yourself up as a trusted middleman, there are several ways to do this. One of the most common is to set yourself up as a service provider. This means that the exchange of money occurs between you & the buyer. You will then hold the money until there is some confirmation that the service has been delivered & then you will transfer the money to the provider. This is how Uber structures itself. The passengers in an Uber taxi have no direct financial relationship with the driver of the taxi. Instead, the passenger pays Uber directly & then Uber pays the driver as a contractor.

This is a perfectly viable approach however, it means that Uber is responsible to guarantee a certain level of service for the passengers. Uber is therefore responsible if the service is poor quality, or if the service is not delivered. By improving the customer experience, Uber therefore dramatically increases their costs – offering refunds, security checks & much more. One of the things you’ll need to understand is, are customers willing to pay you for offering these value added services.

Uber has also run into legal issues with their model. This is because Uber pays their drivers directly & this makes it ambiguous as to if their drivers are employees or contractors. Treating providers as employees brings significant financial and regulatory challenges. To circumvent these challenges, it may be more beneficial to establish a direct financial relationship between the customer and the provider.

It is possible to delay payment without being a service provider. There are several ways to do this. The most common way is to set up an escrow account. Escrow accounts are specialised accounts commonly used in financial transactions to hold funds, or other assets temporarily on behalf of two parties involved in a transaction. The purpose of an escrow account is to provide a secure and neutral third-party intermediary to ensure that both parties fulfil their obligations and protect their interests.

Setting up an escrow account is complex & expensive. Each country has their own laws that regulate how escrow accounts work. Therefore, you will need to consult with local lawyers & make sure you’re not breaching any local laws.

A more manageable alternative is to use a payment gateway provider such as Stripe. Stripe offers escrow-like solutions for marketplaces. For legal reasons, these solutions are not exactly the same as running escrow accounts, however they provide “escrow-like” behaviour with the use of manual payouts. Using one of these solutions will reduce the legal overhead of establishing your own escrow solution & are acceptable for startups without the budget to invest into lawyers. You can then get legal advice about setting up actual escrow accounts once you’re up & running.

Another option used by several marketplaces is to hold credit card information on file for both the buyer & the provider. Marketplace operators can then charge the credit card only once the service has been rendered. Of course you should not store any credit card information inside of your app, but you can store this information at the payment gateway provider level.

Action —

Before continuing, you need to decide on the following:

- Do you want to be a neutral middleman in the transaction & provide this as a value added solution?

- As a neutral middleman, what services will you offer to smooth out the transaction process

- How will you hold money? With the use of escrow, escrow-like accounts or by charging credit cards.

Make a note of your decisions at this stage & then move on to reading about when money should be transferred.

How to move money to the provider

Moving money to the provider is another step in your transaction flow that is unfortunately quite complex. The complexity comes from financial regulators who want to guard against marketplaces being used to launder money. Therefore, before you can move money to a provider you must first gather data on your provider to verify their identity. The data required & the steps that you need to take to verify your provider are known as Know Your Customer (KYC).

The KYC process is one of the reasons why many marketplaces decided not to offer an online payment system at all. However, not taking payments means no commission model so, if you do want to take online payments, it is a good idea to to use a payment processing solution such as Stripe Connect. Stripe Connect collects required information from users and provides it to Stripe. This may include information about the legal entity and personal information about the representative of the business, as well as those who own or control the business. Stripe then attempts verification. In some cases, Stripe may be able to verify an account by confirming some or all of the keyed-in data provided. In other cases, Stripe may require additional information, including, for example, a scan of a valid government-issued ID, a proof of address document, or both.

You might also decide to go one stage further by focusing on just one country (or just one city) – or at least only have your providers in the same country – this way you will avoid having to handle all of the regulatory differences between countries. There are many other compelling reasons to also limit the geographical scope of your marketplace at the start. For example, logistically onboarding providers with a small team is tough.

Action —

Before continuing, you need to decide on the following:

- Are you going to use an off the shelf solution such as Stripe Connect?

- Will you limit the geographical scope of your marketplace?

Make a note of your decisions at this stage & then move on to reading about when money should be transferred.

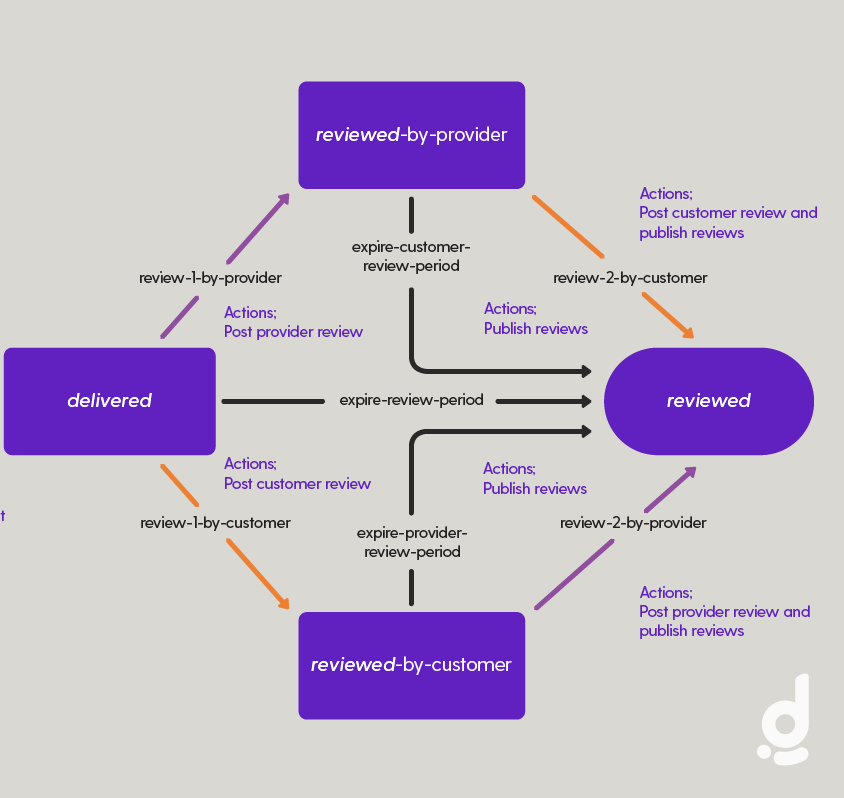

Step 3. Review process ends the marketplace transaction flow

A lot of people think that a two-sided marketplace transaction flow ends after the money has been transferred to the provider. This may be the case with traditional ecommerce, but most modern marketplaces end the transaction flow by letting the customer & provider review each other. These are known as two-sided reviews.

The integrity of two-sided reviews are really important. Users who trust your marketplace review process are more likely to use your two-sided marketplace & pay your commission, rather than transacting off the platform. This is because both customer & provider understand the importance of maintaining a good reputation so that they can continue to find people to transact with on your marketplace. Think about Airbnb – would you book an apartment in a city you’ve never been to, with a complete stranger where they have a 1 star review & lots of complaints.

To help promote the integrity of your review system, you should position your two-sided reviews after the transaction process is complete. This will lower the probability that someone will try & boost their reputation by entering hundreds of fake reviews. Reviews should also contain two components. A numeric value (or star rating) & a text value where the users can leave comments. This captures both quantitative & qualitative user feedback.

Sometimes startups will try & manually “fix” user reviews. They think that maintaining a perception of a quality service is important. This is unethical, but it can also cause you to lose early customers & providers who are unable to obtain the value from the review system.

Another area where startups experience challenges is review extortion. This is when one side of the transaction will threaten to leave a bad review if the other side leaves them a bad review. Airbnb tries to get around this with a double blind system where neither side can see the other’s review until they have both submitted the review. However, often this does not solve the problem & so your two-sided marketplace will eventually need a dispute resolution process.

Action —

Decide where in your transaction flow you are going to place your two-sided review process & if you will implement a double blind system or not. Remember that when designing your two-sided review process, you want to make this super simple so that you can easily complete the transaction flow.

Make a note of your decisions at this stage & then move on to reading about when money should be transferred.

An example transaction process for Airbnb

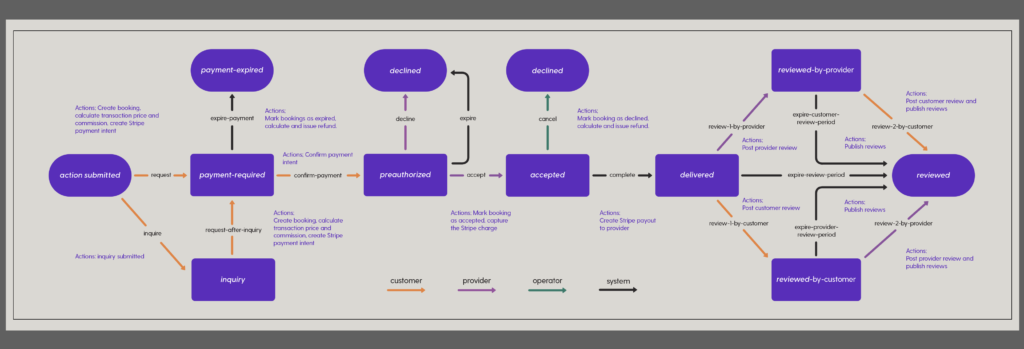

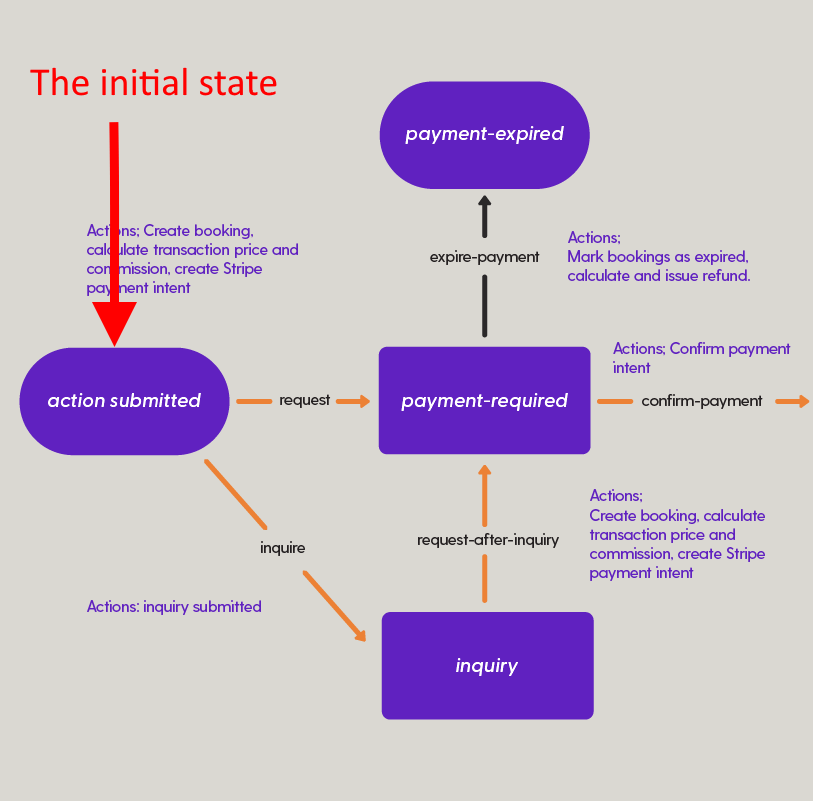

Look at the diagram below. This shows at a low level the transaction flow for something like the Airbnb marketplace. Notice that the diagram includes several stages including the inquiry, payment request, right through to the final two-sided review. All of these steps are included in the transaction flow.

Let’s talk through this diagram step by step.

Okay so – start by looking at the purple coloured nodes on the diagram – these nodes are called states.

States

Each of the purple coloured nodes on the diagram represents a different state of the transaction flow. At the beginning of your transaction you will be in an initial state. This is where the two parties in the transaction are yet to actually meet each other.

After the initial state, the next step is that the buyer can either make an inquiry or make a payment request. An inquiry might be a question that the buyer has about say an apartment listing.

Once the buyer has initiated payment intent, the buyer will enter the payment required state. At this point the customer is required to confirm their payment details. The payment details are then sent off to a bank.

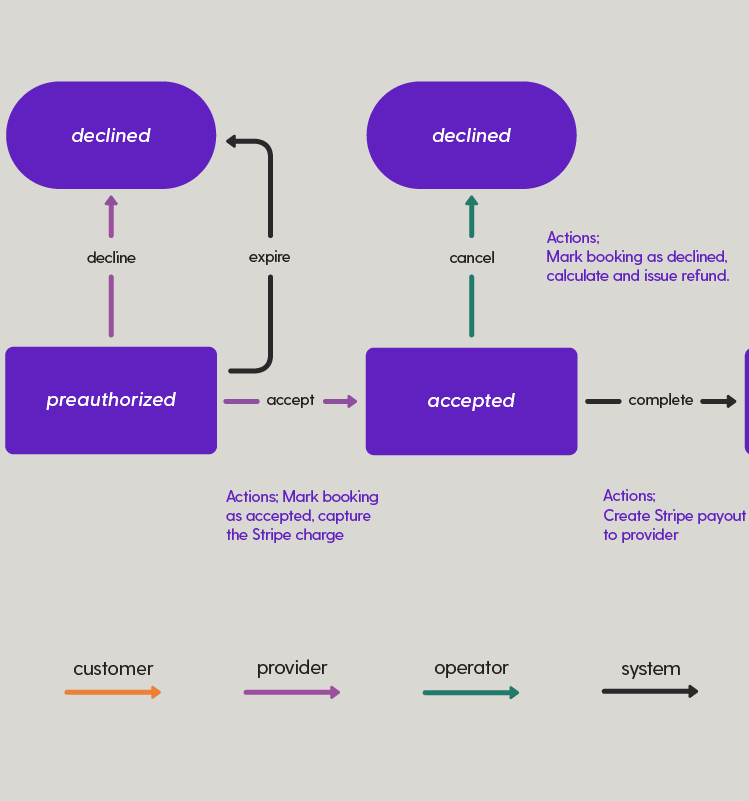

The bank, or payment service provider that you’re using will then confirm that the payment has been made, & this will move the customer through to the next state in the transaction flow which is called preauthorized.

When in the preauthorized state it is up to the provider (or property owner) to either accept or decline the payment. If the provider declines the payment, then we move the customer into the declined state. At this point they are not able to rent the property. If, on the other hand, the customer accepts the payment, then we move the customer into the accepted state.

At the point where the customer is in the accepted state. The accepted state is when the payment has been made & the provider has accepted the payment. At this stage the customer is going to rent their property in return for the payment. On a platform like Airbnb, the customer can actually come in and cancel up to a certain date & so, if they were to cancel, the customer would get a refund from the marketplace at this point.

Assuming that the customer doesn’t cancel, after a certain amount of time the service is provided. This will be when the customer physically shows up at the unit they’re renting & the day of the actual stay will start. At this point the customer moves into the delivered state (as shown below).

The final stage is then the two-sided review. Once the two providers are reviewed, then the reviews get published. This completes the transaction flow & moves the users to a reviewed state.

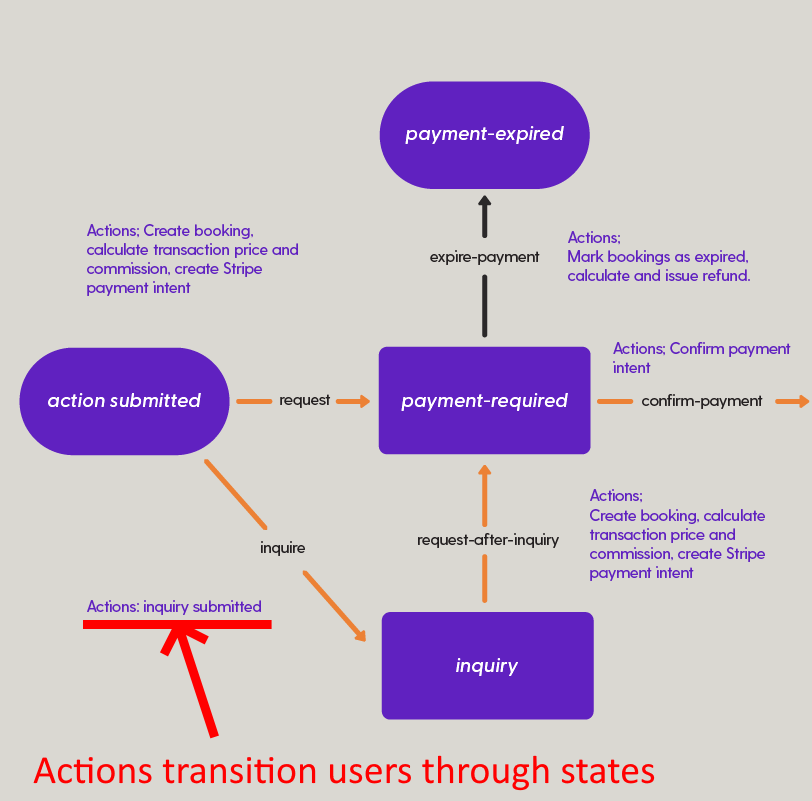

Actions & transitions

On the diagram of the transaction flow, each of the arrows that take the marketplace users between states are called transitions. In order for a transition to take place, a set of things need to happen. These things are called actions. For example, let’s zoom in on the initial state.

In order to get from the initial state to the inquiry state, the buyer needs to submit an inquiry to the provider on the platform. You can see that this action is listed in the purple text that reads Action inquiry submitted. The transition is the red line marked “inquire”.

Although we don’t know all of the steps in the Airbnb process. On the diagram, we have listed out possible actions & tied these actions to transitions. You can read through the diagram & see what each of the actions are.

Summary

This article explains how to design your two-sided marketplace transaction flow. This flow sits at the core of your two-sided marketplace app. Every marketplace will have a slightly different transaction flow, however the goal should be to design a smooth transaction flow that improves the probability of transactions taking place on your marketplace i.e. improves the liquidity of your marketplace.

Now that you’ve read this article & (hopefully) have completed each of the actions, you will have a good idea of how your transaction flow should look. The next step in order to build your two-sided marketplace app is to choose a database structure that fits your transaction process. The database structure will need to capture key bits of information that tie your marketplace users to the different states in the marketplace.

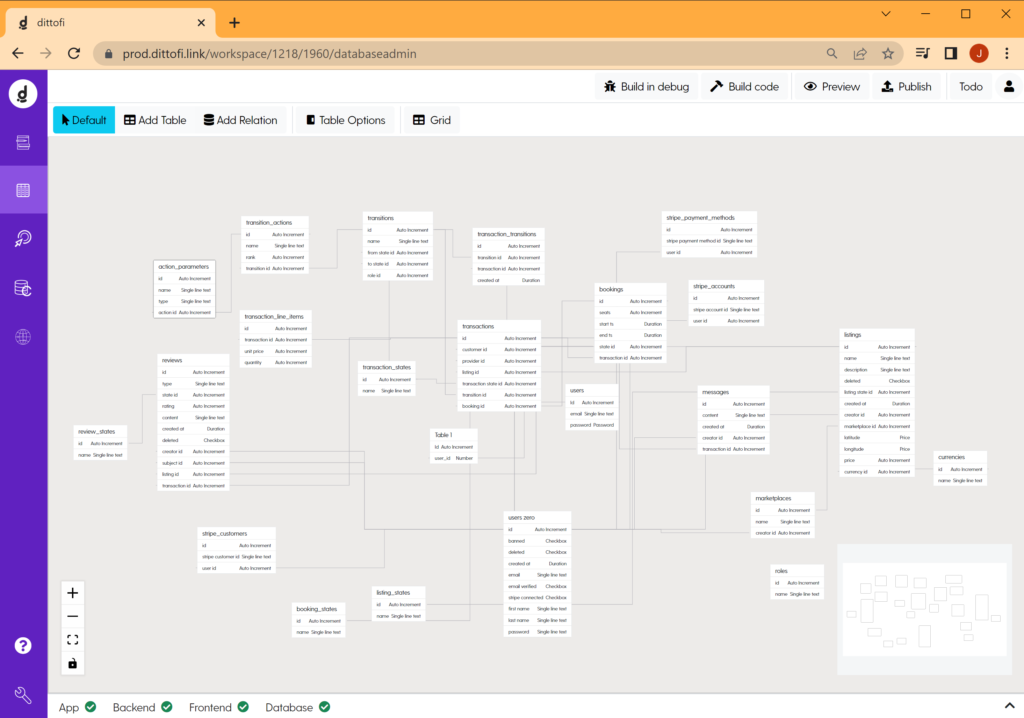

Dittofi has made designing your database really simple, by implementing several enterprise grade database schemas that you can use in your two-sided marketplace app development. Below is a screenshot of how the database design looks inside Dittofi.

Learn how to read & access this database design in the article how to build a two-sided marketplace data model. Then, once you have the database design, we will show you how to build the actions that enable users to transition between different states of the transaction flow.