Turo is a peer to peer marketplace for car rentals based in California, United States.

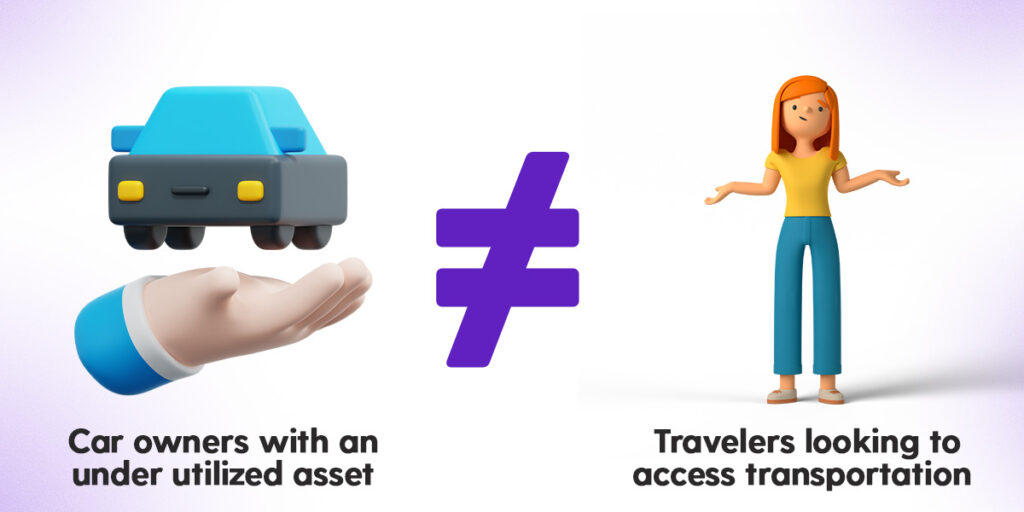

It connects private car owners with renters looking for flexible, short-term vehicle access, operating similarly to platforms like Airbnb but focused on automobiles.

In this article, we break down Turo’s business model, explaining how Turo makes money, the core marketing and sales channels it leverages for growth, the cost structure of its marketplace operations, and an overview of Turo’s major competitors in the car sharing industry.

What Is Turo? How the Peer-to-Peer Car Rental Marketplace Works

In non-technical terms, Turo is the Airbnb of car rentals—a comparison frequently used when explaining the Turo business model to newcomers. In more technical terms, Turo is a location-based, peer-to-peer car rental marketplace that operates in the U.S. and internationally.

- Location based means that the customer must physically be in the same area as the car listing to complete the rental—making local inventory and search filtering essential components of how Turo works.

- Peer to peer (p2p) describes how Turo’s primary users interact on the platform. On a P2P car rental marketplace, the main users are individual car owners and renters—everyday people who either want to monetize their underused vehicles or find affordable alternatives to traditional rental cars.

- Car rental marketplace describes the asset class being offered through the platform. Rental marketplaces can extend beyond cars to homes, land, creative studio space, tools, furniture, and even luxury experiences. Note that P2P rental marketplaces require a very different feature set compared to product marketplaces like Amazon or service-based marketplaces like Upwork.

Now that we understand what Turo is, let’s take a quick look at Turo’s origin story and how it built momentum as a two-sided marketplace.

A Brief History of Turo: From a Simple Idea to a Marketplace Giant

Turo was founded by Shelby Clark in 2009, during his time living in Boston, Massachusetts — a pivotal moment in the Turo startup story and the beginning of what would become one of the world’s most successful peer-to-peer car rental marketplaces.

Despite living in Boston, Shelby strategically chose to launch the car rental marketplace in Baltimore — a city that lacked any significant car-sharing alternative at the time. He began with a basic MVP: a simple website that enabled car owners to upload listings for their personal vehicles. Taking a grassroots approach to building marketplace supply, Shelby printed 10,000 flyers and hit the streets, encouraging car owners to sign up. The public response was mixed — some people eagerly joined the platform, while others were hesitant to rent out their cars to strangers online.

After this early effort, Shelby had 40 car listings on the website. The next critical phase in how Turo started involved growing the demand side of the marketplace and keeping those early car owners engaged. This proved to be a complex challenge that required years of product iteration, marketing experimentation, a change in leadership, and multiple funding rounds before achieving scalable traction.

To learn more about the history of Turo read, how to build a car rental website like Turo.

How Turo Makes Money: Exploring Turo’s Peer-to-Peer Car Rental Business Model

Let’s take a deeper look at Turo’s revenue model and examine exactly how Turo makes money as a peer-to-peer car rental marketplace in 2025.

How Turo Works as a Peer-to-Peer Car Sharing Platform

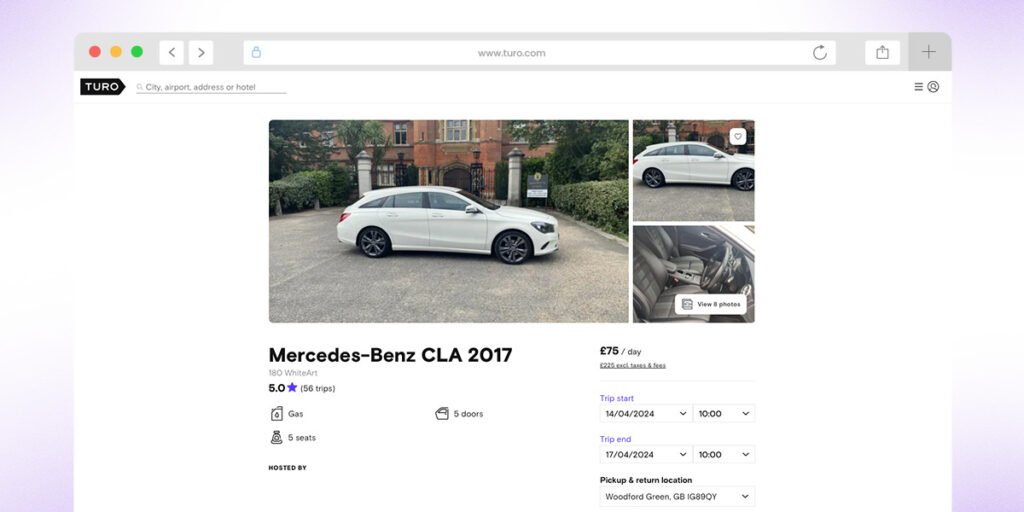

As we’ve seen, Turo is a location-based peer-to-peer car rental platform. The marketplace allows private car owners to log into the platform, create a vehicle profile, upload listing details (including price, location, and availability), and rent out their cars.

Travelers in need of temporary transportation can then browse cars by location, vehicle type, or price, select the vehicle that best matches their needs, and reserve it directly through Turo’s website or app. Payments are processed on-platform, and Turo facilitates the entire transaction—providing value to both sides of the two-sided rental marketplace.

Turo’s Revenue Strategy: The Commission-Based Marketplace Model

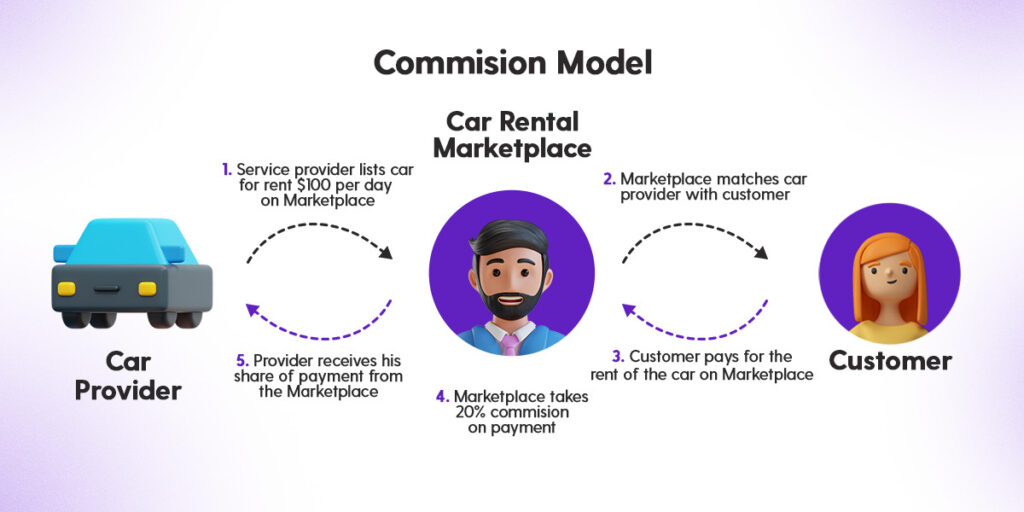

The core of Turo’s monetization strategy is the commission revenue model. Turo makes money by charging a percentage-based service fee each time a rental transaction is completed on the platform.

For example, imagine you’re renting a 2021 Jeep Wrangler Unlimited for $100/day for five days. That’s a $500 total transaction. Turo acts as the intermediary, processing the payment and deducting a service commission—typically between 15% to 45%—before passing the remainder to the vehicle owner.

The average commission fee on Turo tends to hover around 25%, though it varies based on factors like vehicle type, duration, insurance options, location, and demand.

This approach makes Turo a textbook example of how peer-to-peer marketplaces make money using transaction-based monetization. If you’re looking to build a car rental platform like Turo, the commission model is often the simplest and most scalable revenue strategy to start with.

Turo’s Unique Value Proposition for Owners and Renters

Turo is able to charge marketplace fees because it delivers clear, tangible value to both its supply-side (car owners) and demand-side (renters) users.

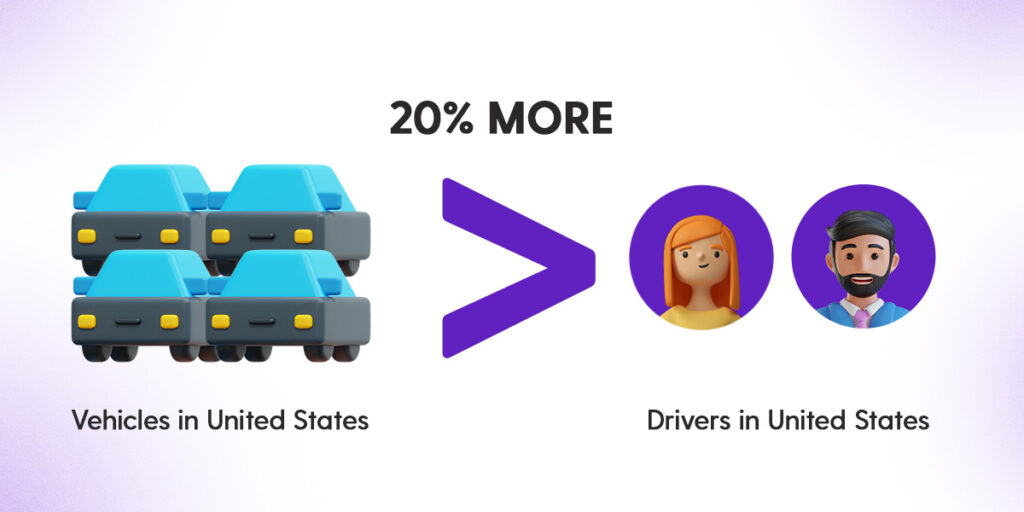

In the U.S., it’s estimated that there are 20% more cars than licensed drivers—millions of privately owned vehicles that are sitting idle and depreciating in value. Turo solves this inefficiency by creating a platform that lets owners monetize their underutilized assets and renters access vehicles affordably and conveniently.

What separates Turo from alternatives like Facebook Marketplace or Craigslist car listings is its end-to-end rental infrastructure. It doesn’t just list cars—it facilitates bookings, collects payments, and provides insurance-backed car sharing services.

Of course, travellers could also look on alternative platforms such as Facebook Marketplace, contact car owners directly and rent from them; however, Turo provides more than just a list of cars. The platform also offers travellers:

- A wide variety of cars at a range of prices

- A simple renting experience where travellers can quickly choose a vehicle, agree on a price, period and mileage and then pick up the vehicle at an agreed location.

Meanwhile, Turo offers car owners:

- An active market of travellers looking to rent out their cars

- Flexible scheduling options to set availability according to their preferences

- Insurance coverage for both owners and renters of up to $750,000, ensuring peace of mind during rentals

- Detailed profiles and reviews to showcase their vehicles and build trust with potential renters

- Access to a large and diverse pool of renters, maximizing the potential for bookings

- Support and assistance from Turo’s customer service team throughout the rental process.

Turo’s Marketing Channels: How Turo Grows Its User Base

Turo’s go-to-market strategy has evolved dramatically since its early days.

Initially, the company operated city-by-city, investing in hyperlocal marketing campaigns. For example, early Turo campaigns targeted local urban travelers needing short-term transportation for errands. But the customer lifetime value (CLTV) from these users was too low to sustain Turo’s marketing spend.

In 2011, Turo’s board appointed Andre Haddad as CEO, who pivoted the business to a national growth strategy. This included rebranding the platform, streamlining the target use case (minimum 1-day rentals), and scaling customer acquisition across the U.S.

Turo’s marketing strategy today includes a mix of online and offline channels:

SEO (Search Engine Optimization) to drive organic traffic from search engines

App Store Optimization (ASO) to increase visibility in app marketplaces

Paid ads across Facebook (Meta), Instagram, and Google Ads

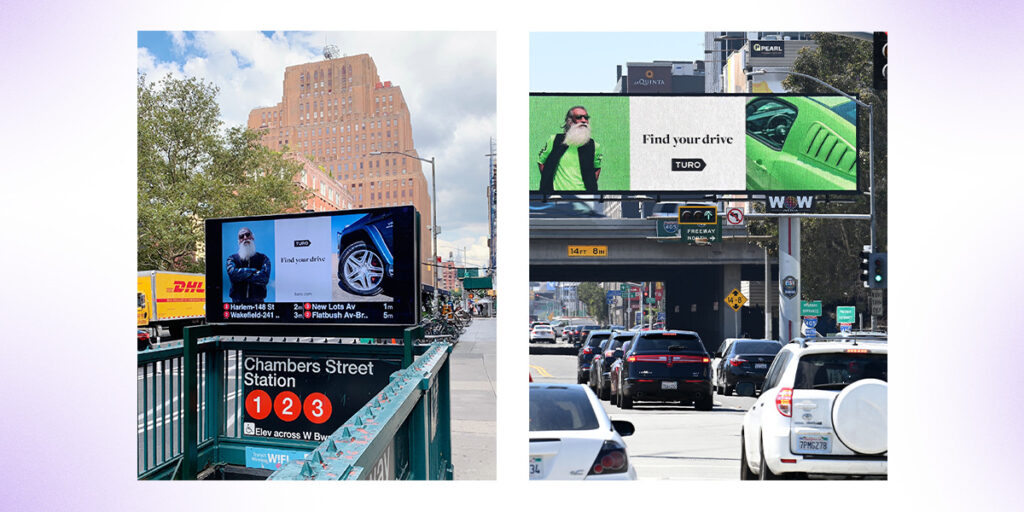

Out-of-home advertising (OOH) like billboards, buses, and transit shelters (especially in dense metro areas like New York City)

Video advertising on TV and streaming platforms to build mass brand awareness

Below is an example of one of Turo’s branded billboard campaigns that ran in Manhattan to target urban travelers looking for flexible, affordable car rentals.

For more information on Turo’s change in business strategy read how to build a car rental website like Turo.

Turo’s cost structure

Turo’s business model requires them to spend money in the following areas.

- Website and app development

- Marketing and branding

- Insurance coverage

- Payments

- Research and development

- Operating costs

Let’s take a quick look at each of these areas and what is included in each now.

1. Website and App Development

As a technology-first car rental platform, Turo invests heavily in website and mobile app development. This includes both new feature development and ongoing software maintenance.

Feature development is important because it ensure that the platform remains competitive. For example, in 2023, Turo introduced a new feature called “instant booking” that streamlines the booking process. The introduction of this feature increased the number of bookings on their platform.

Meanwhile, Turo must invest in maintenance to keep the platform compliant with changes in regulation and third party technology upgrades. Furthermore, with constant upgrades being pushed into Turo’s core code base, bug fixing is an ongoing process in all technology companies.

2. Marketing and branding

Turo’s marketing spend is significant, especially since they operate a two-sided marketplace that needs both supply (car owners) and demand (renters). Their efforts include:

Paid acquisition on Google Ads, Facebook, and Instagram

Out-of-home campaigns (billboards, buses, subway ads)

SEO content for organic growth

Influencer partnerships and affiliate programs

App store optimization

Turo also continuously refines their customer acquisition cost (CAC) and improves lifetime value (LTV) through personalized retargeting and email automation.

Strong branding and ongoing digital marketing are critical to maintaining visibility in a competitive car rental marketplace sector.

3. Insurance coverage

One of Turo’s most important selling points is its insurance offering. The platform provides car owners and renters with up to $750,000 in liability coverage, along with 24/7 roadside assistance.

This protection significantly increases trust in the platform, allowing Turo to monetize both sides of its marketplace. However, offering insurance coverage also introduces substantial recurring costs, including:

Premiums paid to insurance partners

Claim processing and reimbursement workflows

Risk modeling and fraud prevention mechanisms

Insurance infrastructure is a defining component of Turo’s business model and a key competitive differentiator compared to unregulated alternatives like Facebook Marketplace.

4. Payments

Like all other online marketplaces, Turo uses a third party payment provider for their payments infrastructure. In Turo’s case, they use a platform called Braintree which is owned by Paypal. Braintree charges Turo a percentage commission in order to make transactions via them.

5. Research and development

Although we don’t know exactly what top secret research and development (R&D) plans Turo is working on, technology companies all conduct R&D. This allows them to innovate and improve their platform, services and technology. Generally speaking, R&D is different from day to day bug fixing and feature maintenance. This is because it is a type of development that explores the unknown.

For example, in 2023 many tech companies invested in looking at artificial intelligence, machine learning, and data analytics to optimize internal operations and cut costs. This type of R&D was particularly prevalent in the area of customer support where companies trained AI systems to provide automated responses to customer support tickets.

6. Operating costs

All businesses have ongoing operating costs such as rent, utilities, wages, customer support, legal fees and so on. For a detailed breakdown of what the operating costs are that Turo incur, you would need to read Turo’s annual reports. However, the Turo is a private company not a public company and therefore, it is not legally required to publicly disclose extensive financial information.

What Are Turo’s Key Resources That Power Its Marketplace Business?

Turo’s business model thrives thanks to a set of strategic assets and key marketplace resources the company has developed over time. At the core of Turo’s competitive advantage is its two-sided marketplace network effect—a powerful growth engine that drives user acquisition and retention. This network effect has enabled Turo to scale rapidly, now boasting over 14 million registered users and more than 450,000 active car listings across 56 countries, positioning it as one of the leading peer-to-peer car rental platforms globally.

Building a successful car rental marketplace like Turo requires more than just listings; it demands a marketplace flywheel—where more car owners attract more renters, and more renters attract more car owners, creating exponential value on both sides of the platform.

Alongside this core marketplace dynamic, Turo’s key operational resources include:

A growing inventory of private car rental listings and active renters

A team of experienced software engineers and infrastructure developers maintaining a high-performance digital platform

Dedicated customer service and trust & safety teams ensuring seamless renter-host interactions

A strong brand reputation as an innovator in the car sharing and vehicle rental industry

Backing from top-tier venture capital firms and strategic investors, supporting continued innovation and expansion

These foundational elements form the backbone of Turo’s scalable peer-to-peer marketplace model, allowing the company to stay competitive and continue shaping the future of vehicle sharing and rental marketplaces.

Turo’s competitors

Turo competes in a rapidly growing peer-to-peer car sharing and vehicle rental industry. Several major players offer alternative models to Turo’s platform, ranging from traditional rental agencies to innovative P2P services. Here are some of Turo’s top competitors:

- Uber Rentals: Uber Rentals is the car-sharing service offered by the ride-hailing company Uber. The service debuted in 2019 and does not operate a p2p system but rather works as third-party connecting users to other rental services;

- Getaround: Getaround is an American car-sharing company that operates a peer-to-peer car-sharing service that is quite similar to Turo. It was founded in 2009 and is seen by many as Turo’s closest competitor;

- Zipcar: Zipcar is a car rental service that was launched in 2000 and allows users to choose from the fleet of over 12,000 cars that the company maintains;

- The Hertz Corporation: The Hertz Corporation is one of the oldest and largest car rental services in the world. They offer over 12,000 vehicles and operate as a traditional rental service where customers are allowed access to the vehicles for a fee.

Conclusion: How to Build a Peer-to-Peer Car Sharing Business Model Like Turo's

To build a business like Turo, you need to be relentlessly driven. It is not easy to create a company worth more than $1 billion.

All that being said, there are plenty of niche marketplace opportunities out there and with advances in technology, building the tech to support a car rental marketplace has never been easier.

Platform’s such as Dittofi’s hybrid no-code solution allow you to use prebuilt p2p marketplace templates that give you all of the essential features for a marketplace like Turo on day one.

Users can then work within Dittofi’s visual development studio to customize and launch their marketplaces 10x faster than traditional coding, without any vendor lock-in and with 100% flexibility.

If you’d like to discuss how to build a platform like Turo, book a call with one of our marketplace specialists or sign up to Dittofi where you can build an enterprise grade marketplace like Turo using Dittofi’s unique hybrid no-code platform.

Lastly, you can browse some of our other founder stories on the rest of our blog or subscribe to our youtube channel for more updates in the future.

Wishing you the best of luck on your marketplace journey!

Become a Marketplace Insider

Join our inner circle for exclusive insights, coveted trade secrets, and unparalleled strategies – your journey to marketplace dominance begins here.